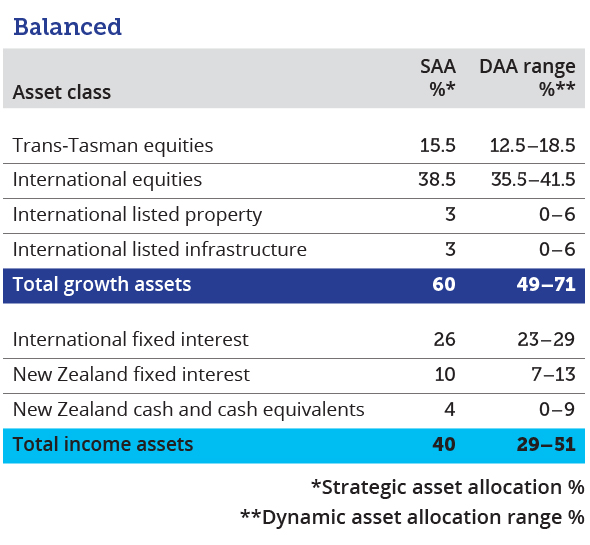

Balanced

Balanced invests in a mix of income assets (e.g. fixed interest) and growth assets (e.g. shares).

Target asset allocation

Investment expectation

To provide medium-level returns with an associated moderate level of risk. As a guide to members, Balanced is expected to provide a long-term return after tax and investment expenses of 2.5% p.a. above the inflation rate, with the likelihood of a negative return approximately 1 year in every 4. Minimum suggested investment timeframe: 8 years.

Estimated fund charges

Estimated total annual fund charges (p.a. of net asset value).

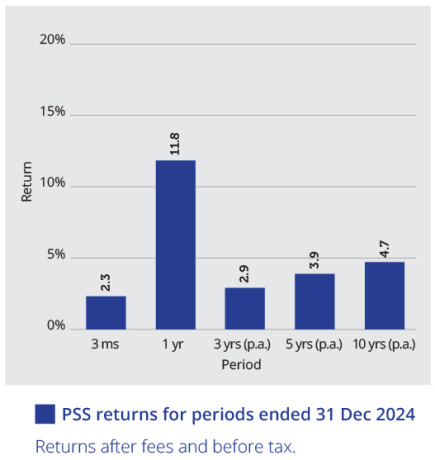

Historical returns

Information about asset classes held by Balanced

Income assets

NZ cash and cash equivalents

Mercer Cash (172 KB)

NZ fixed interest

Mercer NZ Fixed Interest (157 KB)

International fixed interest - global credit

International Fixed Interest – Global Credit (157 KB)

International fixed interest - sovereign bonds

International fixed interest – sovereign bonds (157 KB)

Growth assets

Trans-Tasman equities

Mercer Trans Tasman Shares (148 KB)

International equities

International equities (149 KB)

International indexed equities

International indexed equities (149 KB)

International equities - emerging markets

International equities – emerging markets (149 KB)

International listed property

Mercer Listed Property (198 KB)

International listed infrastructure

Mercer Listed Infrastructure (198 KB)