When it's better not to work hard

A super scheme provider received an angry letter from a member. “How come my account did so badly last year?” he asked. “My mate’s in the same scheme. His money grew, but mine went down 5%.”

Puzzled, the provider looked at the man’s account. He had been busy. At the end of each month, he had looked at which of the provider’s funds had performed best during that month and moved his money into that fund. If he had left his money in his original fund, his return that year would have been 9.2%. Why did he do so badly?

Often in life, past success is a good guide to future success. The winner of the last race is a pretty good bet to do well in this race. Your favourite band or movie director or author is likely to please you with their next offering.

Not so in investing. The type of investment that did really well last year has a pretty good chance of performing poorly this year. The country whose share market soared last year is quite likely to see a drop this year. The fund manager that topped the list last year may well come near the bottom this time around.

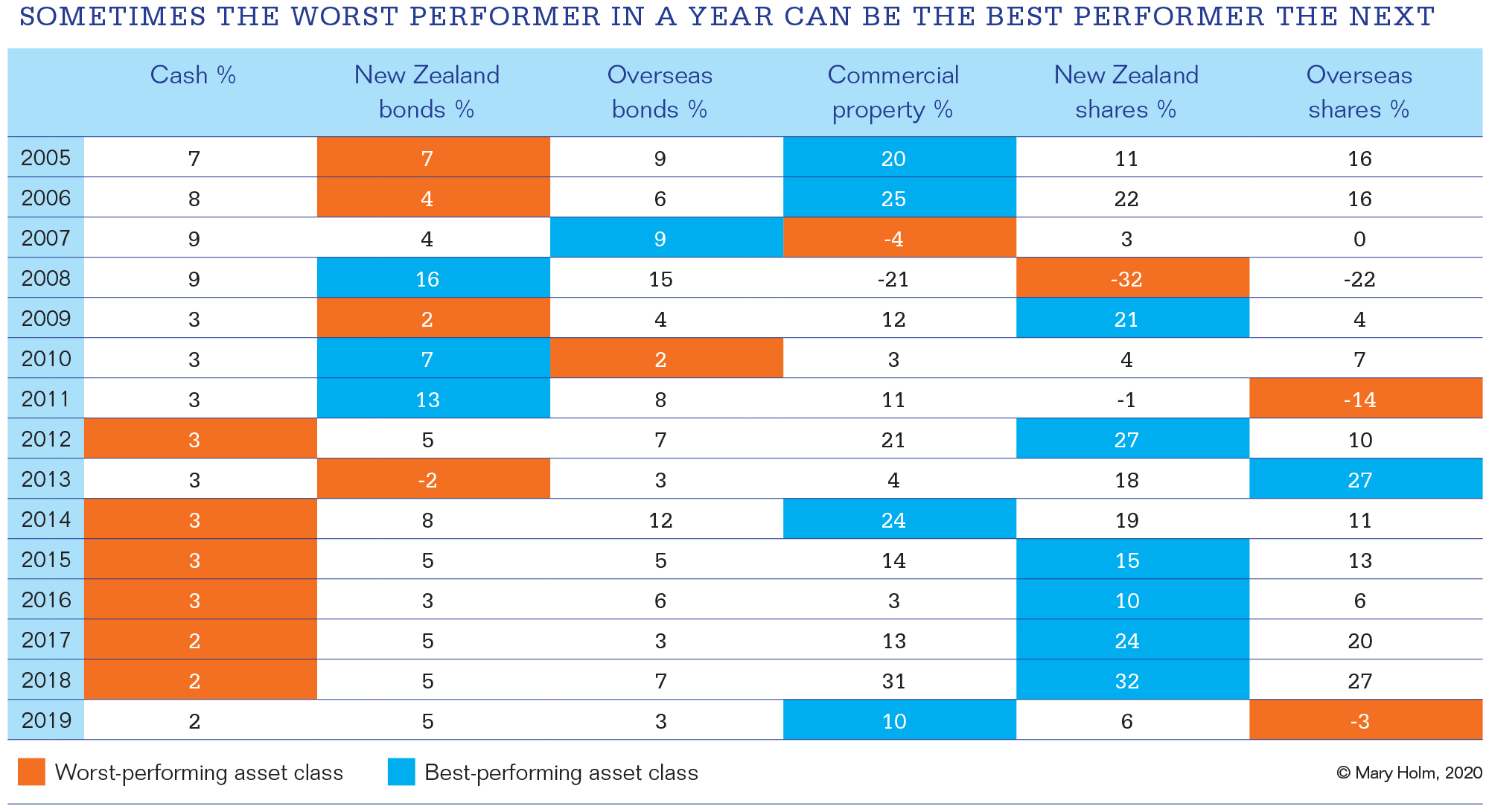

This isn’t always true. Our table shows that sometimes an investment has a good run for several years. But it’s also not uncommon for one year’s top performer to come bottom the next year or the year after.

But research shows that trying to cash in on short-term movements is not easy and doesn’t always pay off. Those who do best are the ones who work out the right type of investment for them and then just stick to it through thick and thin. Bonus: it’s much easier!

The best type of investment for you depends on these things:

- Your tolerance for ups and downs. Earlier in 2020, concerns about COVID -19 sent New Zealand and world share markets sharply downwards – before they recovered again. If that downturn made you panicky, you should probably be in a lower-risk fund.

- When you plan to spend the money. It’s best to put money you plan to spend within 3 years into a low-risk fund so it can’t plunge right before you withdraw it, and 3-year to 10-year money is best in a medium-risk fund. And if you can tolerate some volatility, it’s good to have longer-term money in a higher-risk fund where long-term returns will probably be higher.

For help with choosing your risk level, use the risk profiler.

(c) Mary Holm, 2020