Latest returns

The return on your investment depends on the performance of the investment option(s) you have chosen to invest in. Returns may be negative, nil or positive.

Daily unit pricing

Updated at the end of each trading day

The scheme uses daily unit pricing. When you log in to your account to view your account balances online, you see the unit price, number of units and dollar value for your holding in each investment option. A unit represents a share in a particular investment option. The unit price is based on the net value of all the investments held under that investment option. At the end of each trading day, we declare a unit price for each option, just like a share price. When your contributions are paid into the scheme, you effectively buy additional units based on that day’s unit price. Similarly, when you make a withdrawal, you redeem units to the value of your withdrawal based on that day’s unit price.

Investment management fees and expenses are reflected in the unit price. Tax is not reflected in the unit price. This is because the scheme is a Portfolio Investment Entity (PIE). Taxable income related to your investment in the scheme is taxed at your prescribed investor rate (PIR), which may differ from the personal income tax rate applied to your salary and wages, rather than at a flat rate for the whole scheme. Read more about tax.

Current prices

| After expenses but before tax | Current price 18/04/2025 |

|---|---|

| High Growth | $1.0829 |

| Growth | $1.5824 |

| Balanced | $1.4288 |

| Stable | $1.2877 |

| Cash Plus | $1.2308 |

Percentage returns for this scheme year

Updated monthly

These investment performance figures are based on the change in unit prices over a given period and are expressed as a percentage. Returns are after fees and before tax. Percentage returns on your investment will vary depending on your PIR.

High Growth % |

Growth % |

Balanced % |

Stable % |

Cash Plus % |

|

|

April 2024 |

-2.08 |

-1.98 |

-1.79 |

-1.14 |

0.50 |

|

May 2024 |

1.49 |

1.53 |

1.42 |

0.96 |

0.49 |

|

June 2024 |

1.59 |

1.15 |

1.11 |

0.98 |

0.42 |

|

July 2024 |

2.94 |

3.05 |

2.68 |

1.77 |

0.56 |

|

August 2024 |

-0.09 |

0.45 |

0.73 |

0.96 |

0.45 |

|

September 2024 |

1.23 |

1.26 |

1.20 |

0.92 |

0.48 |

|

October 2024 |

1.18 |

0.34 |

-0.14 |

-0.59 |

0.45 |

|

November 2024 |

3.65 |

3.04 |

2.43 |

1.20 |

0.38 |

|

December 2024 |

0.01 |

-0.54 |

-0.58 |

-0.19 |

0.40 |

|

January 2025 |

2.03 |

1.57 |

1.30 |

0.73 |

0.37 |

|

February 2025 |

-0.88 |

-0.46 |

-0.03 |

0.58 |

0.33 |

Year to date |

11.50 |

9.68 |

8.57 |

6.32 |

4.93 |

PSS vs KiwiSaver

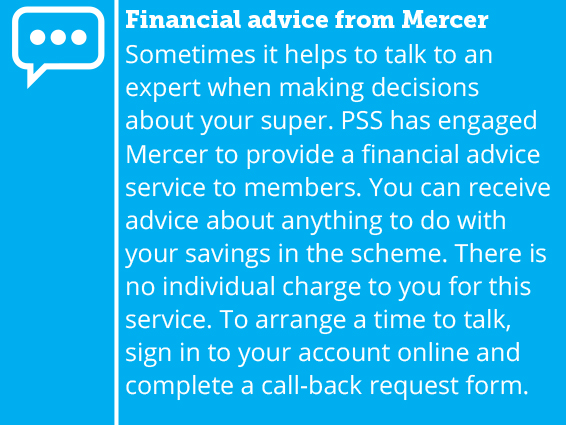

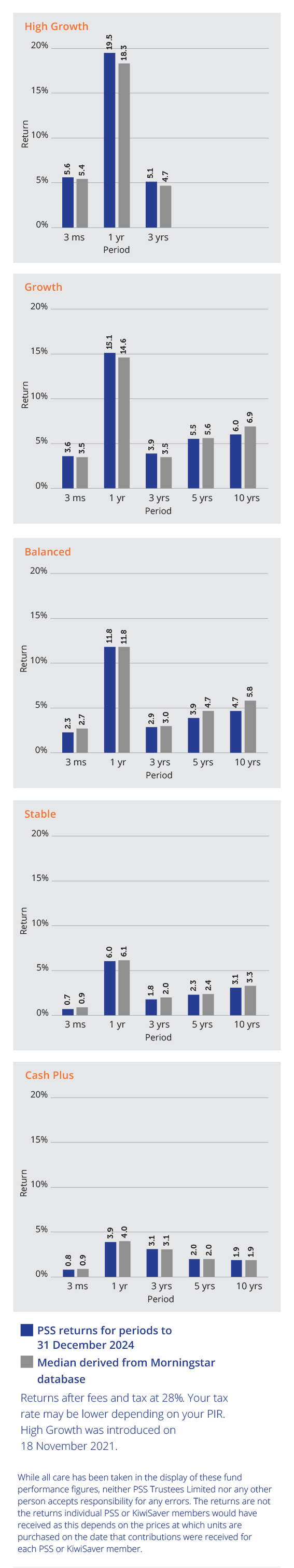

Another way to measure PSS performance against its KiwiSaver peers is to track where PSS funds sit against KiwiSaver funds ranked from lowest to highest. Over the long term, we expect to place consistently in the second quartile (top 50–75%) of KiwiSaver funds with a similar mix of assets. While it might occur, we don’t target the top quartile. To do this, we would need to take on extra risk or invest differently from everyone else. There will always be some who are rewarded, and some who are burnt, for taking more aggressive approach. These funds will typically oscillate between the top and bottom quartiles. Targeting the second quartile is expected to provide more consistent returns over the long term with the intention of avoiding large periods of underperformance. While we don’t look to take on as much risk as our peers, our substantially lower management fees provide a significant advantage.

Historical returns

Returns after fees and before tax. High Growth was introduced in November 2021. 2022 returns for High Growth are for the 5 months to 31 March 2022. Returns for 2020 are for the 9 months to 31 March 2020. Returns for 2015-2019 are for periods ended 30 June.

High Growth % |

Growth % |

Balanced % |

Stable % |

Cash Plus % |

|

|

Periods ended 31 March |

|||||

|

2024 |

16.22 |

12.67 |

10.68 |

6.66 |

5.63 |

|

2023 |

-1.18 |

-4.26 |

-3.95 |

-1.66 |

3.25 |

|

2022 |

-5.92 (5 months) |

5.88 |

2.51 |

-0.72 |

0.53 |

|

2021 |

28.70 |

19.05 |

10.82 |

0.44 |

|

|

2020 (9 months) |

-10.52 |

-6.66 |

-2.81 |

1.21 |

|

|

Periods ended 30 June |

|||||

|

2019 |

5.50 |

6.47 |

5.01 |

2.22 |

|

|

2018 |

7.10 |

5.42 |

4.15 |

2.22 |

|

|

2017 |

11.71 |

8.26 |

4.62 |

2.30 |

|

|

2016 |

4.25 |

5.75 |

6.21 |

2.86 |

|

|

2015 |

5.33 |

5.80 |

4.98 |

3.82 |

Performance against benchmark

Each option aims to outperform its benchmark. You can read more about benchmarks in the statement of investment policy and objectives. This table shows excess returns for periods to 31 December 2024 (before fees and tax).

Cash Plus |

Stable |

Balanced |

Growth |

High Growth |

|

|

1 month (%) |

+0.0 |

+0.1 |

+0.0 |

+0.1 |

+0.1 |

|

3 months (%) |

+0.1 |

-0.3 |

-0.2 |

+0.1 |

+0.4 |

|

1 year (%) |

+0.2 |

-0.2 |

-0.2 |

-0.1 |

+0.3 |

|

3 years (% p.a.) |

+0.2 |

+0.0 |

+0.0 |

+0.1 |

+0.1 |

|

5 years (% p.a.) |

+0.2 |

+0.2 |

-0.1 |

-0.0 |

- |

|

10 years (% p.a.) |

+0.3 |

+0.3 |

+0.3 |

+0.3 |

- |