Stable

Stable invests predominantly in income assets (e.g. fixed interest) with a smaller percentage in growth assets (e.g. shares).

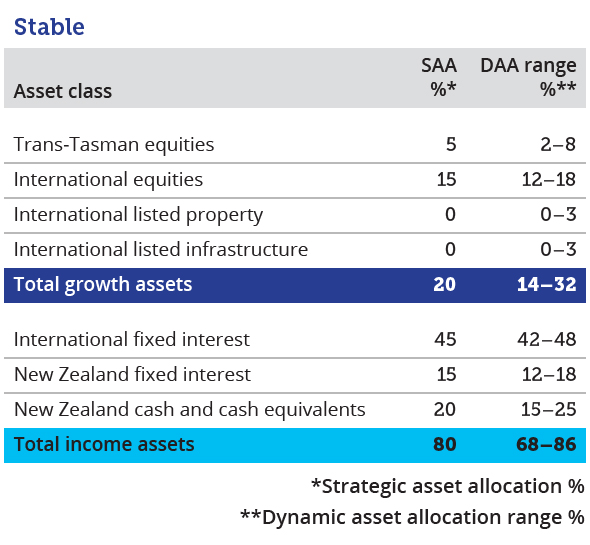

Target asset allocation

Investment expectation

To provide relatively stable returns with a low to medium level of risk. As a guide to members, Stable is expected to provide a long-term return after tax and investment expenses of 1% p.a. above the inflation rate, with the likelihood of a negative return approximately 1 year in every 6. Minimum suggested investment timeframe: 3 years.

Estimated fund charges

Estimated total annual fund charges (p.a. of net asset value).

0.29% p.a.

or $29 for every $10,000 invested

Historical returns

Information for asset classes held by Stable

Income assets

NZ cash and cash equivalents

Mercer Cash (173 KB)

NZ fixed interest

Mercer NZ Fixed Interest (158 KB)

International fixed interest - global credit

International fixed interest – global credit (158 KB)

International fixed interest - sovereign bonds

International fixed interest – sovereign bonds (158 KB)

Growth assets

Trans-Tasman equities

Mercer Trans Tasman Shares (149 KB)

International equities - unhedged

International equities (150 KB)

International equities - hedged

International equities - hedged (150 KB)

International indexed equities - unhedged

International indexed equities (150 KB)

International indexed equities - hedged

International indexed equities - hedged (150 KB)

International equities - emerging markets

International equities – emerging markets (149 KB)

International listed property

International listed property (199 KB)

International listed infrastructure

International listed infrastructure (199 KB)