Comparing performance against KiwiSaver peers

There are several ways to measure PSS performance against its KiwiSaver peers. One is to track where PSS funds sit against KiwiSaver funds ranked from lowest to highest. Over the long term, we expect to place consistently in the second quartile (top 50–75%) of KiwiSaver funds with a similar mix of assets.

Why not target the top quartile?

While it might occur, we don’t target the top quartile. To do this, we would need to take on extra risk or invest differently from everyone else. There will always be some who are rewarded, and some who are burnt, for taking more aggressive approach. These funds will typically oscillate between the top and bottom quartiles. Targeting the second quartile is expected to provide more consistent returns over the long term with the intention of avoiding large periods of underperformance. While we don’t look to take on as much risk as our peers, our substantially lower management fees provide a significant advantage.

How we are tracking

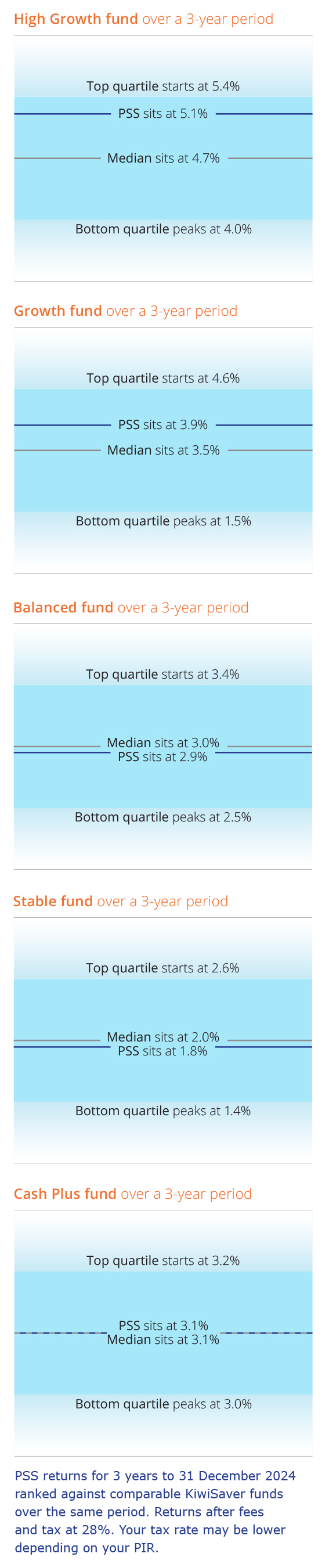

Over time, we expect each PSS fund to place comfortably within the second quartile measured against KiwiSaver funds with a similar mix of assets. The second quartile sits between the median and top quartile. The median is the middle value in a set of numbers ranked from lowest to highest. This graphic shows how we are tracking against this measure since we made significant changes to our investment approach in late 2023.