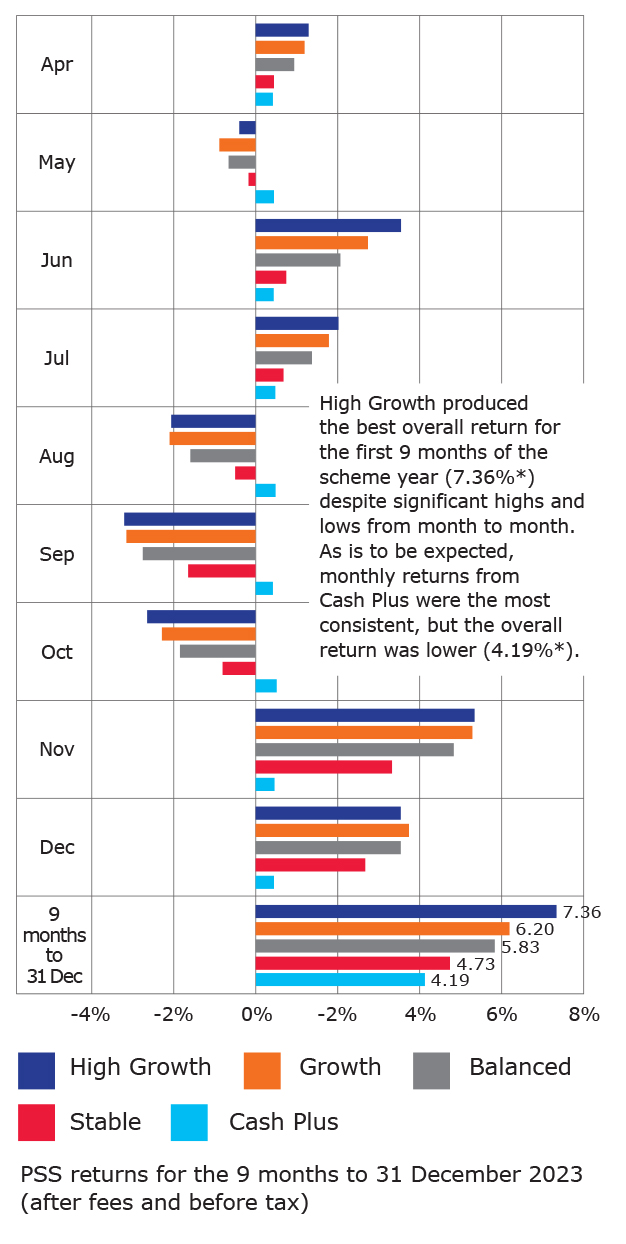

Latest news Strong finish to 2023 boosts year to date returns

There has been a significant uptick in market returns since we last reported to members. At the time, most members had experienced 3 consecutive months of negative returns. However, November and December saw a major turnaround with very strong returns both from equities and bonds. You’ll see from the graph above that High Growth produced the best overall return for the first 9 months of the scheme year (7.36%*) despite significant highs and lows from month to month. As is to be expected, monthly returns from Cash Plus were the most consistent, but the overall return was lower (4.19%*). This illustrates perfectly the concept of volatility. The greater the percentage an option holds of growth assets like shares, the more volatile we expect the returns to be. Returns from options with fewer or no growth assets tend to be less volatile but lower over time. Two takeaways:

- You never know what’s around the corner. Past returns do not predict future performance – a poor month can be followed by a good month; a poor year can be followed by a good year.

- Don’t chop and change investment options – saving for retirement is a long-term game where patience and sticking to a plan has historically been rewarded.

Read Mercer’s market update for the December quarter

*After fees and before tax