Latest news Missing the best days in the market

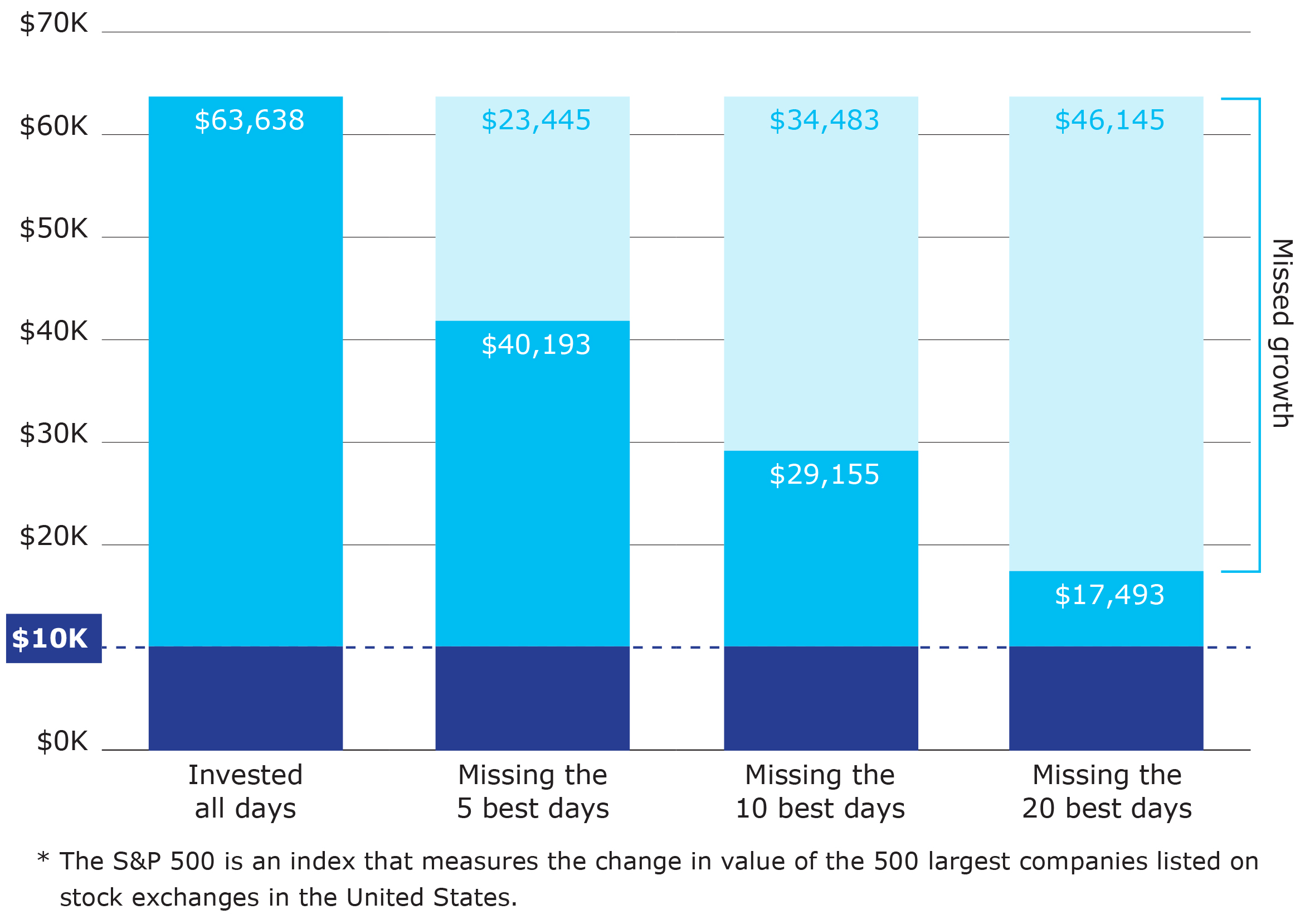

The volatility experienced this year is not unusual or extreme by historical standards. For example, in March 2020, share prices as measured by the S&P 500 index jumped by as much as 9.38% in single day and fell as much as 11.98%. Sharemarkets move in broad cycles known as bull and bear markets. A bull market is when share prices are generally rising and investors are optimistic. A bear market is when share prices are generally falling and investor sentiment turns negative. The trouble is that it’s very difficult to predict when these cycles will begin and end. Also, prices still go up and down within those cycles. There are good days in bear markets and missing good days can be costly in terms of long-term returns. This graph shows the impact of being out of the market on the best days over the past 20 years.

Value of $10,000 invested in the S&P 500* 1 January 2004 – 31 December 2023